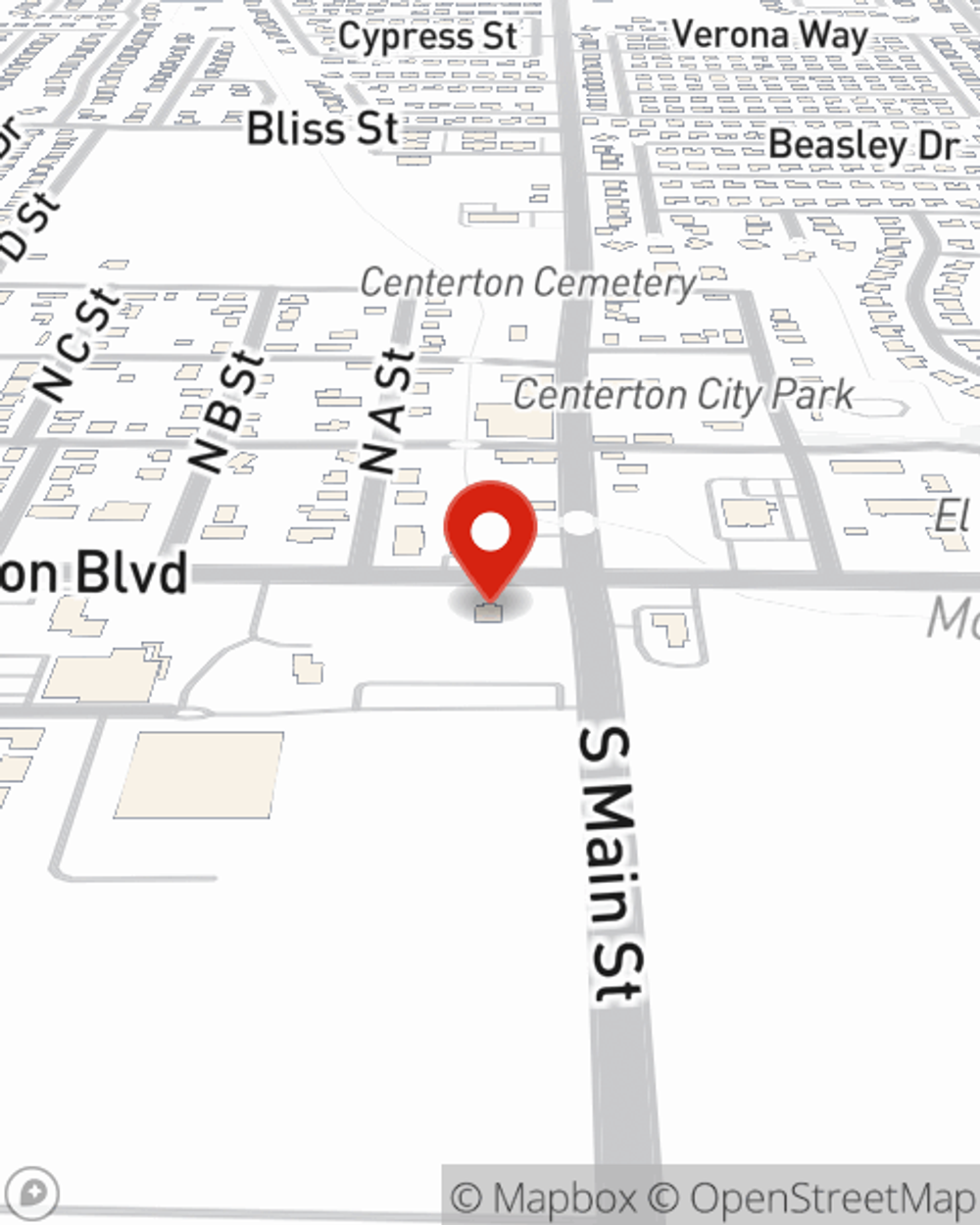

Business Insurance in and around Centerton

One of Centerton’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Benton County

- Washington County

- Centerton, AR

- Bentonville, AR

- Rogers, AR

- Bella Vista, AR

- Cave Springs, AR

- Pea Ridge, AR

- Springdale, AR

- Gravette, AR

- Gentry, AR

- Decatur, AR

- Hiwasse, AR

- Highfill, AR

- Tontitown, AR

- Lowell, AR

- Elm Springs, AR

- Siloam Springs, AR

- Johnson, AR

- Farmington, AR

- Fayetteville, AR

- Prairie Grove, AR

Help Prepare Your Business For The Unexpected.

Do you own a real estate appraisal business, a tailoring service or a cosmetic store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

One of Centerton’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Your business thrives off your tenacity creativity, and having great coverage with State Farm. While you do what you love and make decisions for the future of your business, let State Farm do their part in supporting you with commercial liability umbrella policies, business owners policies and artisan and service contractors policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Garrett Youngblood is here to help you review your options. Call or email today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Garrett Youngblood

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.